Handling our personal finances happens more and more frequently via mobile: we’ve shifted from having to go to the bank in person, to managing our accounts on our computer, to finally logging into a smartphone app to send and receive money, by a few simple taps.

For all companies in finance and banking, having a customer-facing mobile app is indispensable. By now, we know that mobile has an important role in attracting and retaining users. But how big is its actual impact on the company’s total revenues? Are companies aware of this and do they in their mobile teams accordingly?

A while back, we released a report, Mobile product success in finance and banking. As a part of our research, we asked some questions from senior mobile leaders within the industry. We were curious to learn more about three main things: how a mobile app impacts total revenues, how much of the engineering budget is dedicated to mobile, and how the heavy regulations and compliance requirements of the industry affect mobile teams.

The results are in:

From 108 senior mobile leads in finance and banking companies who got back to us:

- At least 84% of respondents say that revenues via mobile make up a large percentage of their total revenue, and nearly half of all respondents say that it accounts for more than 75%.

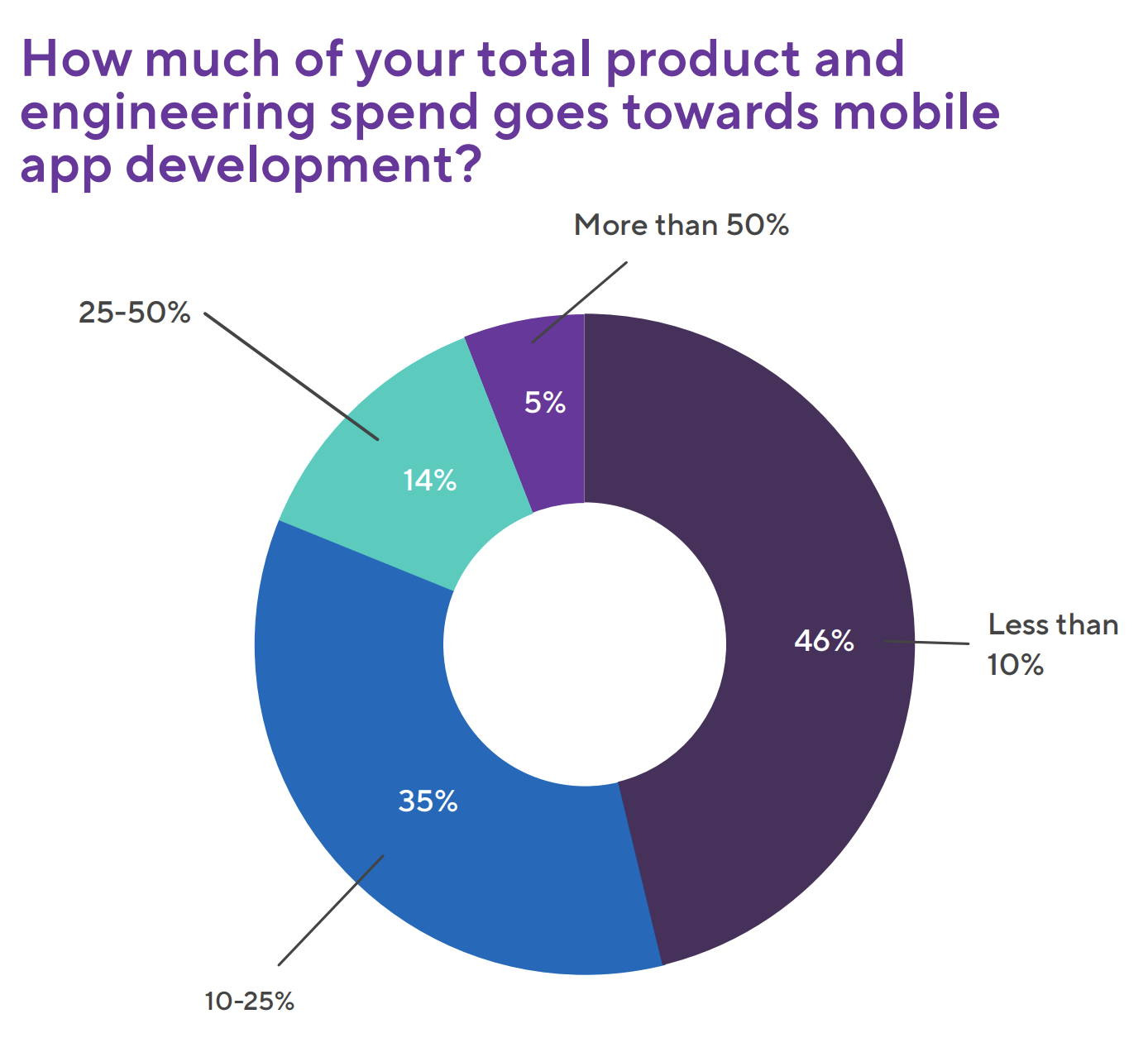

- Even though mobile has a huge impact on total revenue, most engineering teams still don’t allocate larger parts of their budget to their mobile app team.

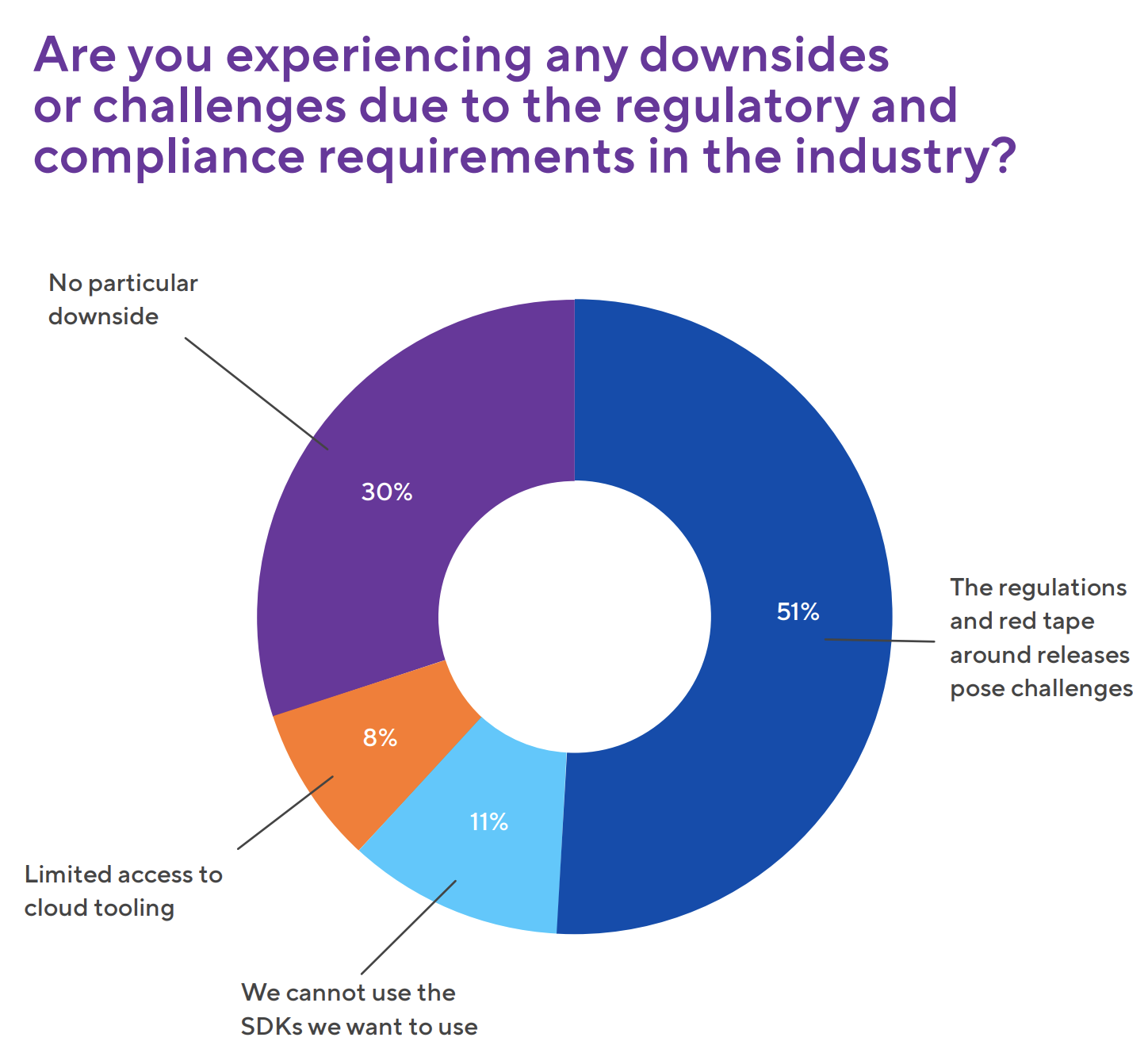

- Over half of respondents say that industry regulations and red tape can significantly slow down pushing out new features.

- When mobile makes up an important part of a company’s business, managing the regulatory and compliance-related bottlenecks becomes an even larger issue.

Now let’s see the answers visualized:

With 84% of respondents saying that mobile accounts for over half of total revenues, the results speak for themselves. This underlines the importance of being able to provide an immaculate mobile experience to users, one that’s free of crashes, outdated features, and slow loading times.

Interestingly, those who answered that an estimated 75% or more of their revenue is impacted by mobile in the previous question tend to experience the issues related to industry regulations more. In their case, the percentage of those who said they face red tape-related challenges jumped up to 94%.

In most teams, investment primarily happens in other aspects of engineering, with mobile still not being a priority. However, as we see from the first question, in most teams, mobile touches a huge part of total finance and banking revenue. As teams become better at connecting mobile excellence to business impact, will we see these numbers shift and mobile product investment grow?

More resources

If you’re interested to learn more about the state of mobile in finance and banking, you can download our latest report that delves into engineering best practices and features interviews with industry experts.

You might also enjoy these articles exploring various aspects of fintech:

- How Bitrise helped N26 double speed, triple release frequency, and enhance security

- How to release finance apps quickly and confidently with DevSecOps

- Building innovative and secure financial services that help users save money — featuring Neo Financial

- How to fit agile methodologies into the constraints of fintech app development? — featuring N26

- Dojo: empowering businesses with real-time transactions insights, accessible anywhere

- Wise & Bitrise case study

- Afterpay by Dovetail

.jpeg)